Saudi Arabia held oil price at artificial low levels

- curbing Russian involvement in Syria

- Collateral damage:

small shale Oil companies

required USD$80/ barrel to breakeven operations

- [35 shale oil companies](https://marcellusdrilling.com/2015/11/list-of-36-oil-gas-companies-that-filed-for-bankruptcy-in-2015/) filed for chapter 11

- caught in precarious position of being over-leveraged and unprofitable for extensive periods of time

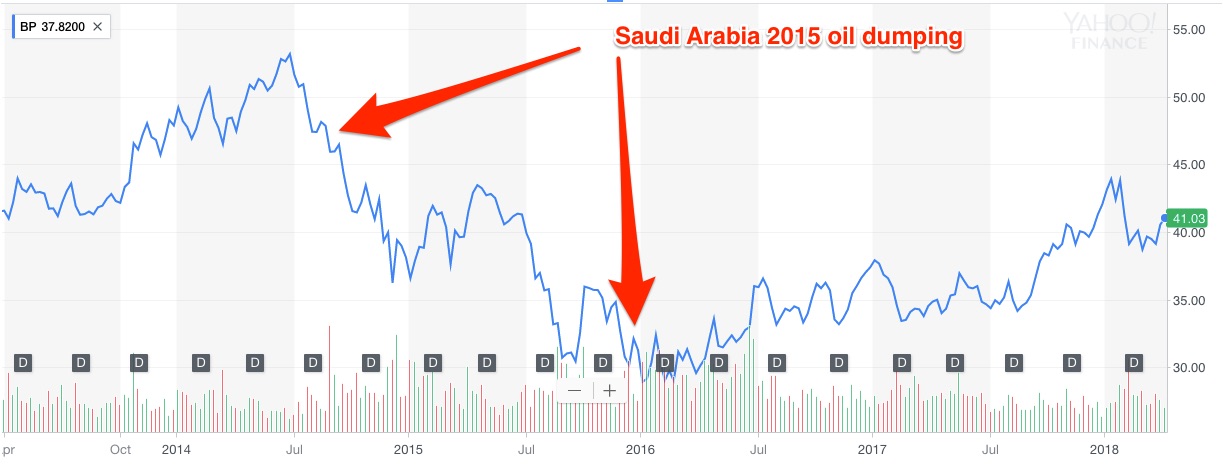

- Large oil companyBP

trading at close to Net Book Value for more than a year (2016-2017)

- price still recovering after 2 years (2018)

- Countries can hold an industry suppressed longer than impacted companies can stay liquid

- large cap companies will trade for extensive periods at close to net book value. Might be a good buy when markets turn around

- If industry is directly affected, cut losses and bail

Related

- [Devised strategy](http://garyteh.com/2018/04/trading-strategy-capitalizing-on-loss-aversion/) to avoid trading losses of this nature