Overview

This post documents how we identify negative macro downtown.

Heurisitics

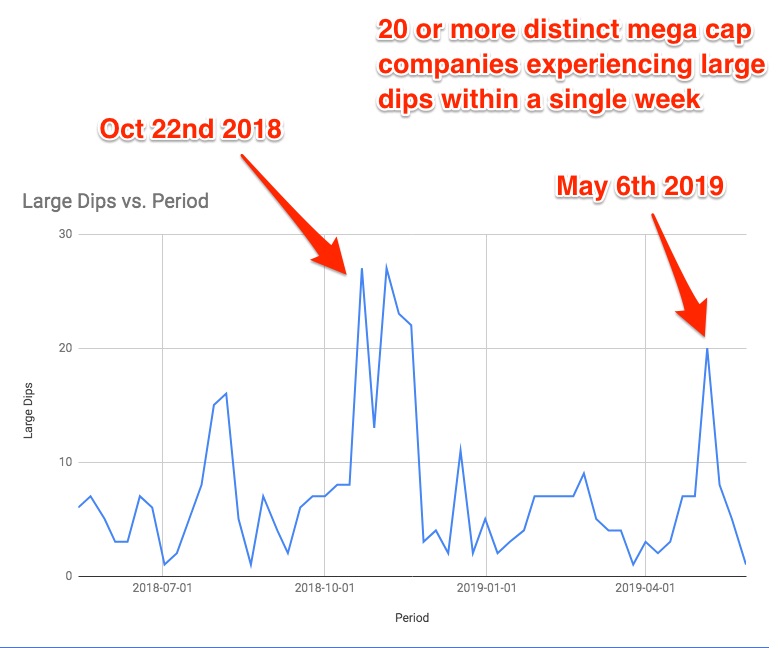

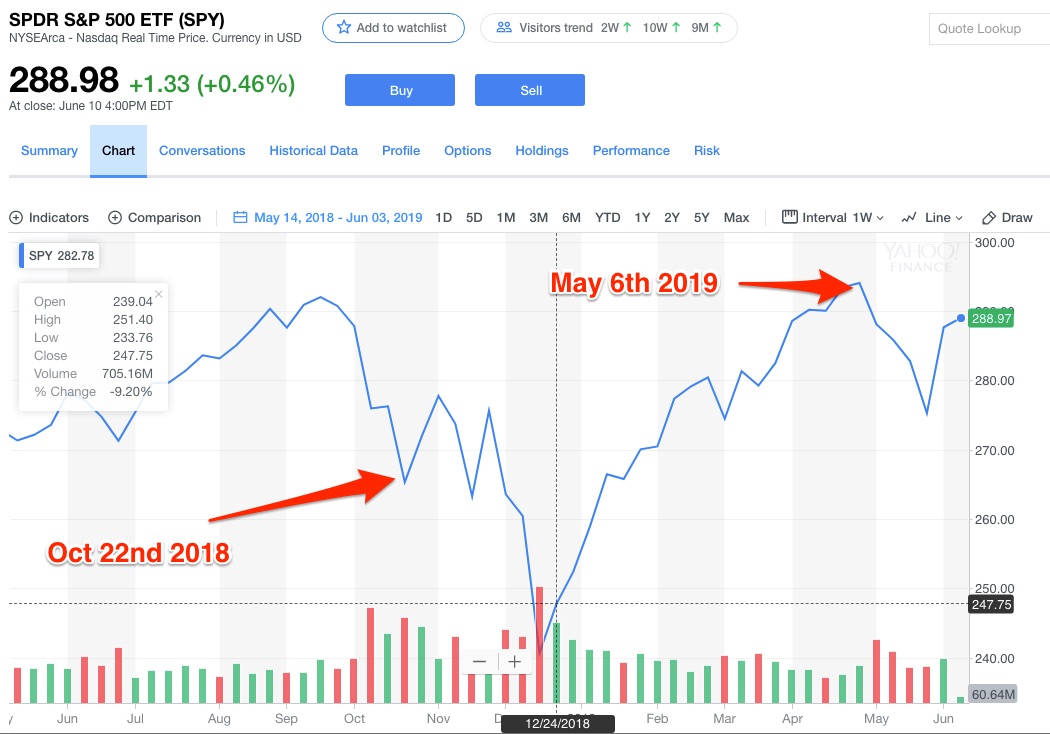

- When more than 20 companies within the mega cap area experience large dip within a week, it is a good indication that macro economics trend has shift

- Verify by cross referencing with SQP, QQQ and ^RUT

- During this scenario, it might make sense to shift position into SRTY

Related references

- [Mega cap companies large dip benchmarks against market indexes](https://docs.google.com/spreadsheets/d/1K10Vm4cSczZ4jg0i24BRvED77afzPekczA_SNEckVrM/edit?usp=sharing)

- [US/China May 2019 market correction](https://garyteh.com/2019/06/june-4th-2019-us-china-trade-war-loss-aversion-reversion-to-mean-pattern/)

- [Loss aversion reversion to mean anti-pattern to observe](https://garyteh.com/2019/05/loss-aversion-reversion-to-mean-anti-pattern/)

- [Loss aversion reversion to mean trading strategy](https://garyteh.com/2018/04/trading-strategy-capitalizing-on-loss-aversion/)

- [World news sentiment analysis](https://trends.getdata.io)