On US banks

- they pay interest on deposits from customers and either borrow out the money to lenses or purchase short term US treasury . The spread between deposit interest rate paid to customers and US treasury yield/loan interest rate charged to lender is their profit

- they charge lenders interest above long term treasury yield rate and finance the loan through either their own deposits or from borrowing

- US Banks with deposits above USD122.3million needs to meet minimum reserve requirements of 10% imposed by the Federal reserve as of 2018

Meeting minimum reserve requirements

- Borrow from Federal Fund Rate based on central bank interest rates

Used within US economy

- rates are higher

- hassle free

- The federal funds rate is set in U.S. dollars and

- charged on overnight loans.

- The fed funds rate is the interest rate at which commercial banks in the US lend reserves to one another on an overnight basis

- London Interbank Offered Rate (LIBOR) -

Used internationally

- Borrow from other banks

- rates are lower based on global supply and demand equilibrium

- based on USD, EURO, Sterling, Swiss Franc, Yen

- Quotations:

overnight, one week, and

- one, two, three, six, and 12 months.

Federal reserve debt structure

- US treasury bills:

short term maturity at one year or less.

- Sold at discount

- paid fully at maturity

- US treasury notes:

1 year to 9 years maturity

- Sold at face value

- pays fixed interest rates every six months.

- Sold auction style.

- US treasury bonds:

10 years to 30 years maturity.

- Sold at face value and

- pays fixed interest rates every six months .

- The original vehicle.

- Registered to single owner and cannot be resold.

Federal Interest rate hike

- Long term interest rate tend to react faster to hikes then short term interest rates

- Long term Federal interest rates are used as benchmarks by banks to determine interest to charge lenders.

- To prevent hyper inflation (price stability) after all employable people within the country have been employed into the economy.

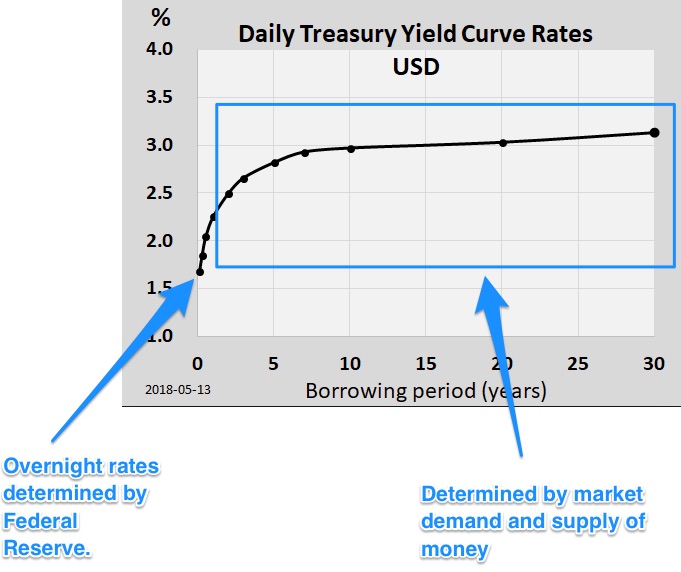

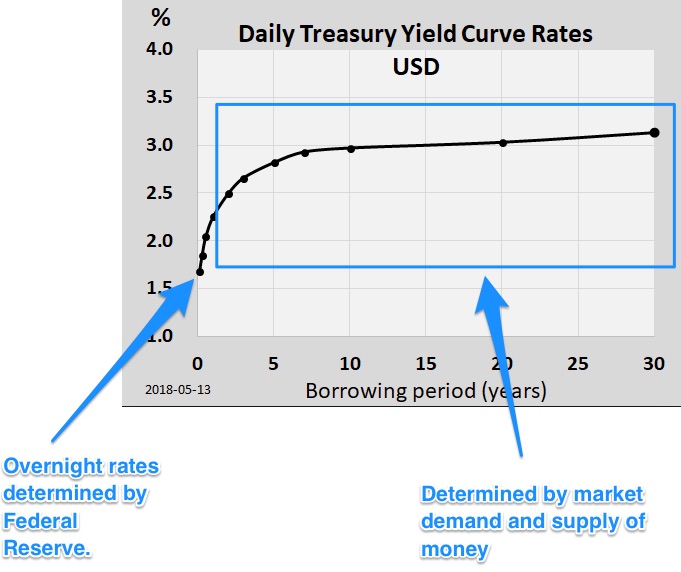

Understanding the yield curve

- Interest rates are considered the cost of money

- The Federal reserve only manipulates the overnight interest rate

- Longer term interest rates are determine by demand and supply of money

- The Federal reserve increases the overnight interest rate by reducing the supply of money in circulation. This is achieved by supplying more short term securities in the open market, .

- The Federal reserve decreases the overnight interest rate by increasing the supply of money in circulation. This is achieved by buying up short term securities in the open market.

- Long term interest rates are higher than short term interest rates because long term interest rates require you to endure greater interest-rate uncertainty as well as greater likelihood of government default

Related readings

- [Understanding treasury yield and interest rates](https://www.investopedia.com/articles/03/122203.asp)

- [Understanding US bonds, notes and bills](https://www.investopedia.com/ask/answers/difference-between-bills-notes-and-bonds/)

- *The bank credit analysis handbook*, Jonathan L. Golin and Philippe Delhaise