Types of federal monetary policy environment

- Expansive

- Indeterminate

- Restrictive

Expansive monetary policy

- Small cap companies benefits by gaining easier access to credit for expansion

- Mortgage REITs experience lower interest rate expenses and improved profit margin

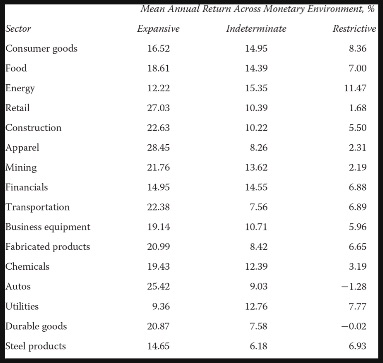

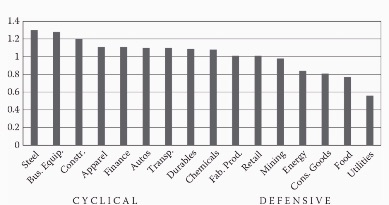

- cyclical sectors will tend to outperform during this period - tends to have high beta

autos

- construction

- manufacturing

- technology

Restrictive monetary policy

- Small cap companies will experience more difficulties raising capital to fund expansion as compared to blue chip companies

- Equity REITs will outperform Mortgage REITs during this period

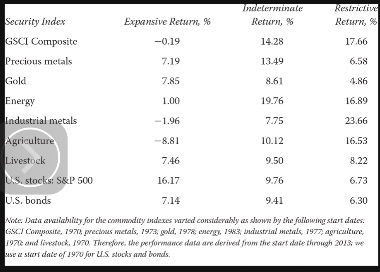

- Commodities will out perform in a restrictive monetary policy environment aimed at curbing inflation - especially industrial metals

Consistent performance across all monetary policy environment

Tends to have low beta

- energy

- utilities

- food

- financing

- consumer goods

Stages of business cycles

- Early stages

- Late stages

Early stage of business cycle

- Technology and transportation will outperform

Late stage of business cycle

- Consumer staples and energy will outperform

International strategies

- Scandinavian countries have the least correlation against US economy

- Scandinavian countries has the least amount of debt to GDP versus

US

- other European countries

- Scandinavia countries have a higher savings rate

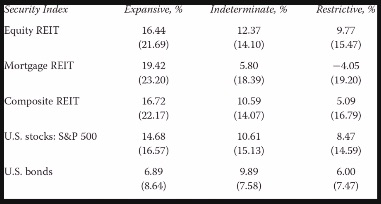

[caption id="attachment_3853" align="alignnone" width="381"] REITs returns versus Stocks and Bonds across various monetary policy environments[/caption]

REITs returns versus Stocks and Bonds across various monetary policy environments[/caption]

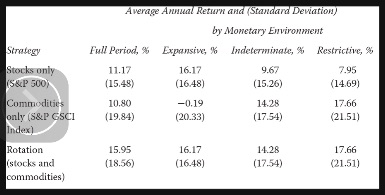

[caption id="attachment_3854" align="alignnone" width="385"] Strategy returns across various monetary environments[/caption]

Strategy returns across various monetary environments[/caption]

[caption id="attachment_3856" align="alignnone" width="380"] Commodity returns and asset class returns in various monetary policy environments[/caption]

Commodity returns and asset class returns in various monetary policy environments[/caption]

[caption id="attachment_3855" align="alignnone" width="383"] Sector returns in various monetary policy environments[/caption]

Sector returns in various monetary policy environments[/caption]

[caption id="attachment_3859" align="alignnone" width="389"] Sector beta[/caption]

Sector beta[/caption]