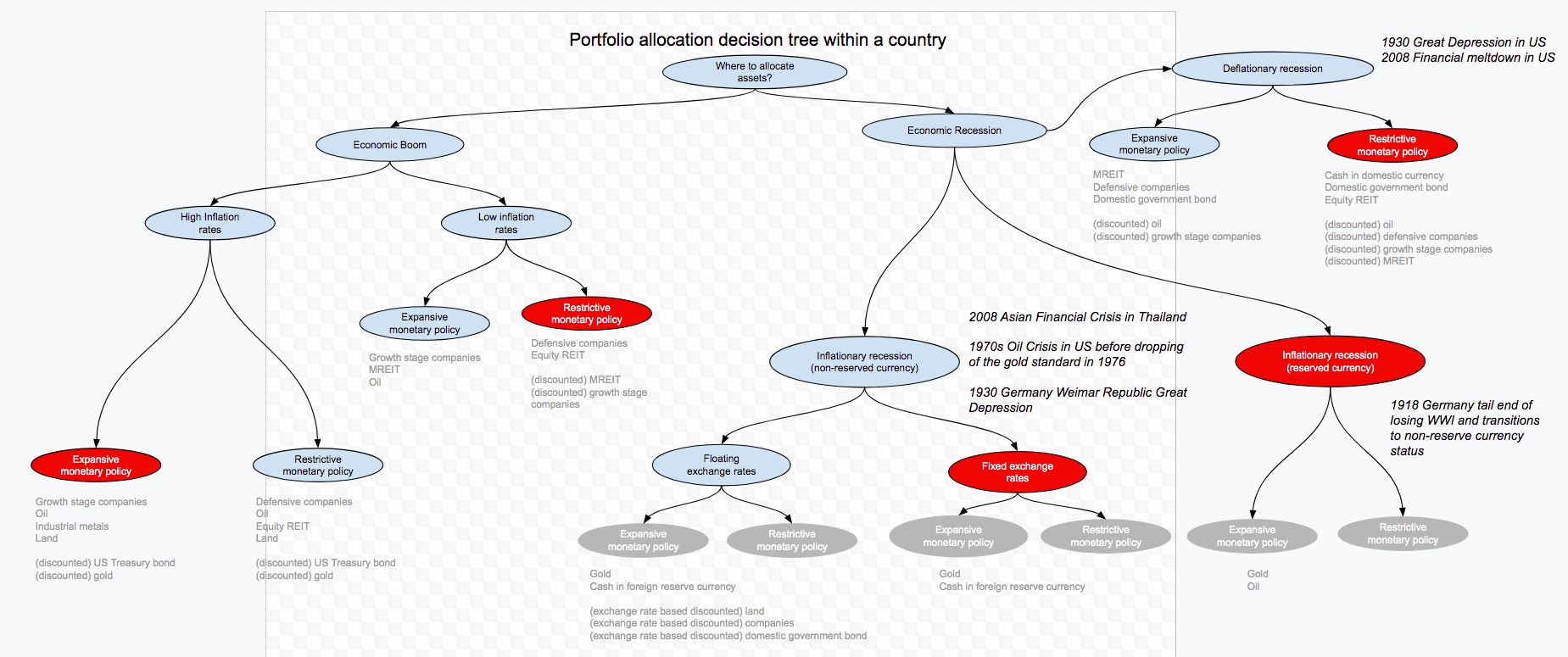

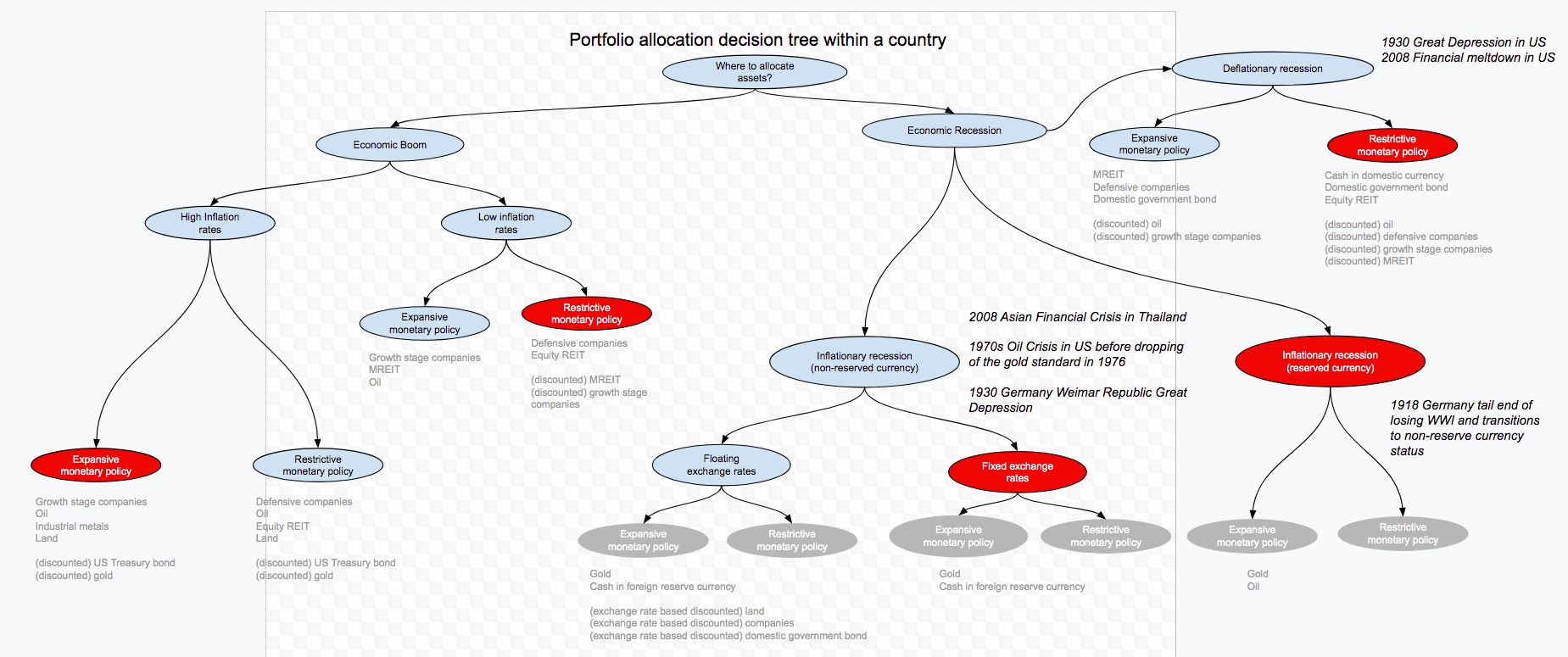

Investment environment parameters

- Economic cycle

boom

- recession

- Inflation rates

High

- Low

- Currency type

Reserved currency

- Non reserved currency

- Exchange rates regime for non reserved currency owners

Fixed exchanges rate

- Floating exchange rates

- Recession type

(hyper) inflationary

- deflationary

- Federal reserve monetary policy

restrictive

- expansive

Asset class types

Government bonds

- good position to hold when government is unlikely to default and threat of inflationary recession looms

interest rates are inflation adjusted

- high opportunity cost to hold position when economy is booming

Cash

- good position to hold when hyper deleveraging is occurring within the system and Federal reserve has not responded with expansionary monetary policy

- high opportunity cost to hold position when economy is booming

Mortgage REIT

- good position to hold when threat of deflationary recession looms and the Federal reserve have started loosening monetary policy.

- a tenuous position to hold during periods of hyper inflation because the interest gets offset by the inflation

- a tenuous position when the Federal reserve starts tightening monetary policy

- a tenuous position to hold when over leveraging is rampant within the system

- high opportunity cost to hold position when the economy is booming

Equity REIT

- good position to hold when the Federal reserve starts tightening monetary policy.

Credit becomes less available and thus more expensive

- number of construction project drops

- less supply driving up demand for existing inventory

- high opportunity cost to hold position when the economy is booming

Gold

- Use as a protection against hyper inflations

- a tenuous position when the economy is in the early stage growth

demand for gold will drop as more funds gets allocated to risk assets

- a tenuous position when the economic is heading into deflation

there is less money/credit within the system as compared to the amount of gold

Oil

- Useful for hedging against outbreak of war

- a tenuous position when recession and economic activity worldwide slows

Growth companies

- Useful for riding an economy boom

- a tenuous position to hold during the late stage of a credit cycle when too much leverage has been built up within the system and valuation is excessive

Value companies

- Useful for riding a deflationary recession when credit becomes more expensive

- High opportunity cost when economy is booming.

Related references

- *[Invest with the Fed,](https://garyteh.com/2019/09/book-summary-invest-with-the-feds-by-robert-r-johnson-gerald-jensen-and-luis-garcia-feijoo/)*[ Robert R Johnson, Gerald Jensen and Luis Garcia Feijoo](https://garyteh.com/2019/09/book-summary-invest-with-the-feds-by-robert-r-johnson-gerald-jensen-and-luis-garcia-feijoo/)

- [*Understanding Big Debt Crisis*, Ray Dalio](https://garyteh.com/2019/09/book-summary-understanding-big-debt-crisis-by-ray-dalio/)

- [List of economic crisis, wikipedia](https://en.wikipedia.org/wiki/Panic_of_1837)

- [*Manias, panics and crashes*, Charles Kindleberger and Robert Aliber](https://garyteh.com/2019/07/manias-panics-and-crashes-balance-of-trade-mechanism/)

- [*The Asian financial crisis*, Shalendra Sharma](https://garyteh.com/2019/08/book-summary-the-asian-financial-crisis-by-shalendra-sharma/)

- *The end of wall street*, Roger Lowenstein

- [*When genius failed*, Roger Lowenstein](https://garyteh.com/2019/08/key-lessons-from-when-genius-failed-by-roger-lowenstein/)

- [*The bank credit analysis handbook*, Jonathan Golin and Philippe Delhaise](https://garyteh.com/2019/07/book-summary-the-bank-credit-analysis-handbook-by-jonathan-golin-and-philippe-delhaise/)

- [*The Fate Of Rome*, Kyle Harper](https://garyteh.com/2019/05/book-summary-the-fate-of-rome/)

- [*The savings and loans crisis* by James Barth Susanne, Trimbath and Glenn Yaho ](https://garyteh.com/2019/08/book-summary-the-savings-and-loan-crisis-lessons-from-a-regulatory-failure/)

- *The Snowball*, Alice Schroeder

- *The bitcoin standard*, Saifedean Ammous