- History inevitably repeats itself

- If a trend is occurring that you don’t have a good idea of how it will pan out, it is more likely because you have not lived in a time where a similar situation had happened before and less likely because a similar situation had happened before

- Application of FinTech is to make it possible to leverage on assets that we have like the following:

- Human Capital

- Social Capital

- Real Assets

- An economy built on talent versus an economy built on natural resources and tourism tends to grow faster

- Singapore versus Jamaica

- important to educate local population to ensure they do not become second class citizens in their own country to highly qualified expats

- Three Kingdoms – Cao Cao versus Yuan Shao

- Singapore versus Jamaica

- Algorithms for decision making

- Be wary of purely deriving algorithms through data mining and regression analysis.

- The user of this algorithm will not be able to decipher causation versus correlation

- The training data available might be missing existing significant events

- The algorithm should instead be a derivation of your own thought processes. Computers/algorithms should be used to complement human decision making instead of replacing it.

- Be wary of purely deriving algorithms through data mining and regression analysis.

- An environment of radical transparency is helpful towards supporting idea meritocracy

- helps match individuals strong in one area with other individuals strong in complementary areas.

- A real world ensemble decision tree model

- On China

- Main challenges the country face

- Debt restructuring

- Economic restructuring – the need to shift away from export focused economy to domestic focused economy

- Develop capital markets

- Balance of payments

- Developments to date

- debt being restructured

- economic restructuring happening dealing with state owned enterprises. Fast development of cutting edge industries. AI advancements comparable to US

- capital markets like Hong Kong depth of liquidity is impressive

- balance of payment is being dealt with effectively due to capable leaders and ability to control via levers unique to a strong central government

- Strong emphasis on kids education

- Reinforcing Integrity of law through eliminating corruption

- Main challenges the country face

Reflections for the afternoon

Betting on technology companies that fall into one of the three categories

- aggregators of trust

- aggregators of financial liquidity

- aggregators of data

On aggregators of data, bet on the storage caching layer as opposed to the presentation layer. The former is harder to displace than the latter

Lateral thinking: To derive as many possible application/implication of the same insight as possible.

Book summary: the success equation

- When more skilled than opponent, make rules simpler to reduce variance introduced by luck

- when being the underdog, make rules more complex to introduce variance introduced by luck

- imoortant to differentiate luck and skill

- when situation is mainly dependent on luck judge likelihood of outcome by base rate

- when situation is mainly dependent on skill, judge likelihood of outcome base on single success story

- practices equanimity towards luck

- focus on practice to improve skill

Humor of the day

Reminder to Engineers involved in related projects: When automating and replacing every single conceivable task associated with the preparation of a wonderful dish with AI, please don’t replace the person who is suppose to experience the joy of tasting the dish with a machine

Insights for one on ones with Friend said in Singapore

- Countries are starting to feel threatened by a centrally controlled Chinese economy that works

- one belt on road

- tight coordination between government and companies

- relationship was good until 2008 before which US helped China grow rapidly

- Trump’s tactic as a strategy to consolidate control in the government

- of lowering tax rates for bringing back funds to US

- tariffs on other countries to drive up USD exchange rate

- VC might consider doubling down on existing companies

- impact

- Chinese economy slowing down

- Chinese merchants extracting money from companies and laying low while tsunami passes

- US companies implicated

- most Singapore companies not thriving

- increased occurrences of suicide in Singapore

- Port activities slowing down in Singapore, potentially moving to Tuas Area

- will last for next 7 years

- demand for entertainment/tourism will increase to stave off feelings of aimlessness

- Tired looking grab driver

- On transition period for next four years

- high risk and uncertainty

- foreigner disadvantaged in US with Trump as president

- be wary of entering into legal agreement overseas

- tech trend

- when everybody going high tech

- Time to go really low tech

- focus on cash flow and avoid liabilities

- Go into farming and buy a piece of land

- Uber caused a lot of accidents in Singapore hence banned

- NUS school of computing requires students to have triple AAA in their A levels before they could even be considered for admission

Contacts

- Thomas Gorissen

- Peter Gwee

- Jim Ellis

- Dad

- Garis

- WenKang

- Mr Khoo

Kenji and Johnson – Learnings in trading patterns

- Volume always precedes price movement

- A drastic increase or decrease in price movement without corresponding volume is not sustainable

- Discussions on the following platforms can be used as raw materials

- SeekingAlpha

- Yahoo finance

- investor village

- Bloomberg news costs USD1000 per month but is not real time and mainly editorial

- private investors that are not hedge fund managers will want this product if it exists

Useful resources

- Laughing at Wall Street

Loss aversion and reversion to mean earnings missed patterns

Companies that exhibited pattern

Netflix

- Earnings date: July 16th 2018

- Pre-earnings price: USD416

- After hours base price: USD340

- Next day opening price: USD359

- Net gain: 5.58%

- Earnings date: July 25th 2018

- Pre-earnings price: USD220

- After hours base price: USD168

- Next day opening price: USD178

- Net gain: 5.9%

Spotify

- Earnings date: May 3rd 2018

- Pre-earnings price: USD170

- After hours base price: USD154.25

- Next day opening price: USD158

- Net gain: 2.5%

External references

Reflections on the decentralized multi-sided market place – GetData.IO

The beginning

The concept of GetData.IO was first conceived back in November 2012. I was rewriting one of my side project (ThingsToDoSingapore.com) in NodeJS back then. Part of the rewrite required that I wrote up two separate crawlers each for a different site which I was getting data for.

Very soon after I was done with the initial rewrite, I was once again compelled to write a third crawler when I wanted to buy some stocks on the Singapore stock exchange. I realized while the data for the shares were available on the site, they were not presented in a way that facilitated my decision making process. In addition to that, the other part of the data I needed were presented on a separate site and unsurprisingly not in the way I needed.

I was on my way to write my fourth crawler when it occurred to me, if I structured my code by cleanly decoupling the declaration from underlying implementation details, it is possible to achieve a high level of code re-use.

Two weekends of tinkering and frenzied coding later, I was able to complete the first draft of the Semantic Query Language and the engine that would interpret this query language. I was in love. Using just simple JSON, it allowed anybody the ability to declare the desired data from any parts of web. This includes data scattered across multiple pages on the same site or data scattered across multiple domains which could be joined using unique keywords.

The Journey

Five years have past since, during this time, I brought this project through an incubator in Singapore with my ex-co-founder, tore out and rewritten major parts of the code-base that did not scale well, banged my head countless times on the wall in frustration due to problems with the code and with product market fit, watched a bunch of well-funded entrants came and went. To be honest, quite a few times I threw in the towel. Always, the love for this idea would call out to me and draw me back to it. I picked up the towel and continued ploughing.

It’s now June 2018. Though it has taken quite a while, I am now here in the Bay Area, the most suitable home for this project given to the density of technological startups in this region. My green card was finally approved last month. I have accumulated enough runway to allow my full attention on this project for the next 10 years. Its time to look forward.

The vision

The vision of this project is a multi-sided market place enabled by a Turing complete Semantic Query Language. The Semantic Query Language will be interpreted and executed upon by a fully decentralized data harvesting platform that will the capacity to gather data from more than 50% of the world’s websites on a daily basis.

Members can choose to participate in this data sharing community by playing one or more of the 4 roles:

- Members who need data

- Members who maintain the data declarations

- Members’ who will run instances of the Semantic Query Language interpreter on their servers to mine for data

- Member’s who sell their own proprietary data

From this vantage point, given its highly decentralized nature, it feels appropriate to deploy the use of block chains. The final part that needs to be sorted out prior to the deployment of blockchain to operate in full decentralized mode is figure out the “proof of work”.

Operations available in other database technologies will get ported over where appropriate as and when we encounter relevant use cases surfaced by our community members.

Why now and how is it important?

More as I dwell in this space, I see very clearly why it is only going to become increasingly important to have this piece of infrastructure in place. There are namely 3 reasons for this.

Leveling the playing field

The next phase of our computing will rely very heavily on machine learning. It is a very data intensive activity. Given that established data siren’s like Facebook, Google, Amazon and Microsoft have over the past years aggregated huge tons of data, this have given them a huge unfair advantage which might not necessarily be good for the eco-system. We need to level the playing field by making it possible for other startups to gain easy access to training data for their machine learning work.

Concerns about data ownership

GDPR is a cumulation of concerns of data ownership that has been building for the past 10 years. People will increasing want to establish ownership and control over their own data, independent of the data siren’s use to house them. This means a decentralized infrastructure which people can trust to manage their own data.

Increasing world-wide need for computing talents

Demand for engineering talent will only continue to increase as the pervasiveness of computing in our lives increase. The supply of engineering talents does not seem like it will be catching up and short fall is projected to continue widening till 2050. A good signal is the increasingly high premium paid to engineering talents in the form of salaries over the recent years. It’s just plain stupidity as a civilization to devote major portions of this precious engineering resource to the writing and rewriting of web crawlers for the same data sources over and over again. Their time should be freed up to do more important things.

The first inning

Based on historical observation, I believe we are on the cusp of the very first inning in this space. A good comparison to draw upon is the early days of online music streaming.

Napster versus the music publishers is similar to how the lay of the land was back 5 years ago when Craigslist was able to successfully sue 3Tap.

Last year, LinkedIn lost the law suit against folks who were scraping public data. This is a very momentous inflection point in this space. Even the government is starting to the conclusion that public data is essentially public and Data Siren’s like any of the big Tech should have no monopoly over data that essentially belongs to the users who generated them.

Drawing further upon on the music industry analogy, the future of this space should look like how Spotify and ITunes operate in the modern day online music scene

What about recumbents?

…

Further readings

Brian Rothenberg – Building market places from zero to billions

Key points for building market places

Key points for building market places

- The only thing that matters: Build liquidity – the first one there wins

- sellers can expect their items will sell

- buyers can expect to buy items at price they can accept

- cross side network effects – one side drives the other side

- Always start with building building Supply first

- seek out inefficient, fragmented markets that you can roll up

- look for fragmented + high friction for supply sign up

- pick method that works for your target market

- Methods

- trojan horse strategy – provide immediate value through the offer of the use of a tool – SAAS model

- can help bootstrap the project

- Eventbrite was a event management SAAS model before it became a market place for events

- Manual hack #1 – Yelp

- Web crawling

- Clean data and categorize

- pull out key insights and distribute

- upload data into directory and invite service providers to claim their profiles

- Brute force

- hire 300+ remote team

- Plug into existing liquid network

- PR + timing

- get customers to promote your brand

- TripAdviser

- trojan horse strategy – provide immediate value through the offer of the use of a tool – SAAS model

- Challenges

- In the short run supply is always the challenge

- In the long run demand is the bottleneck

- Network effects create virtually impenetrable barriers to entry

- retention grows

- increasingly attractive economics

- reaching scale as fast as possible matters

- Competition

- horizontals are going vertical

- horizontals that fail to go vertical lose market shares – craiglists

- moving forward focus on building niche networks

- technology shifts sometimes open new windows to attach horizontal market positions

- Winner either take most or takes all

- Operations

- track satisfaction / separate NPS for both supply and demand side

- more satisfied demand side drives growth

- very powerful dynamic:

- look for overlap between buyers and sellers

- Uber / Lyft

- Meetup.com

- look for overlap between buyers and sellers

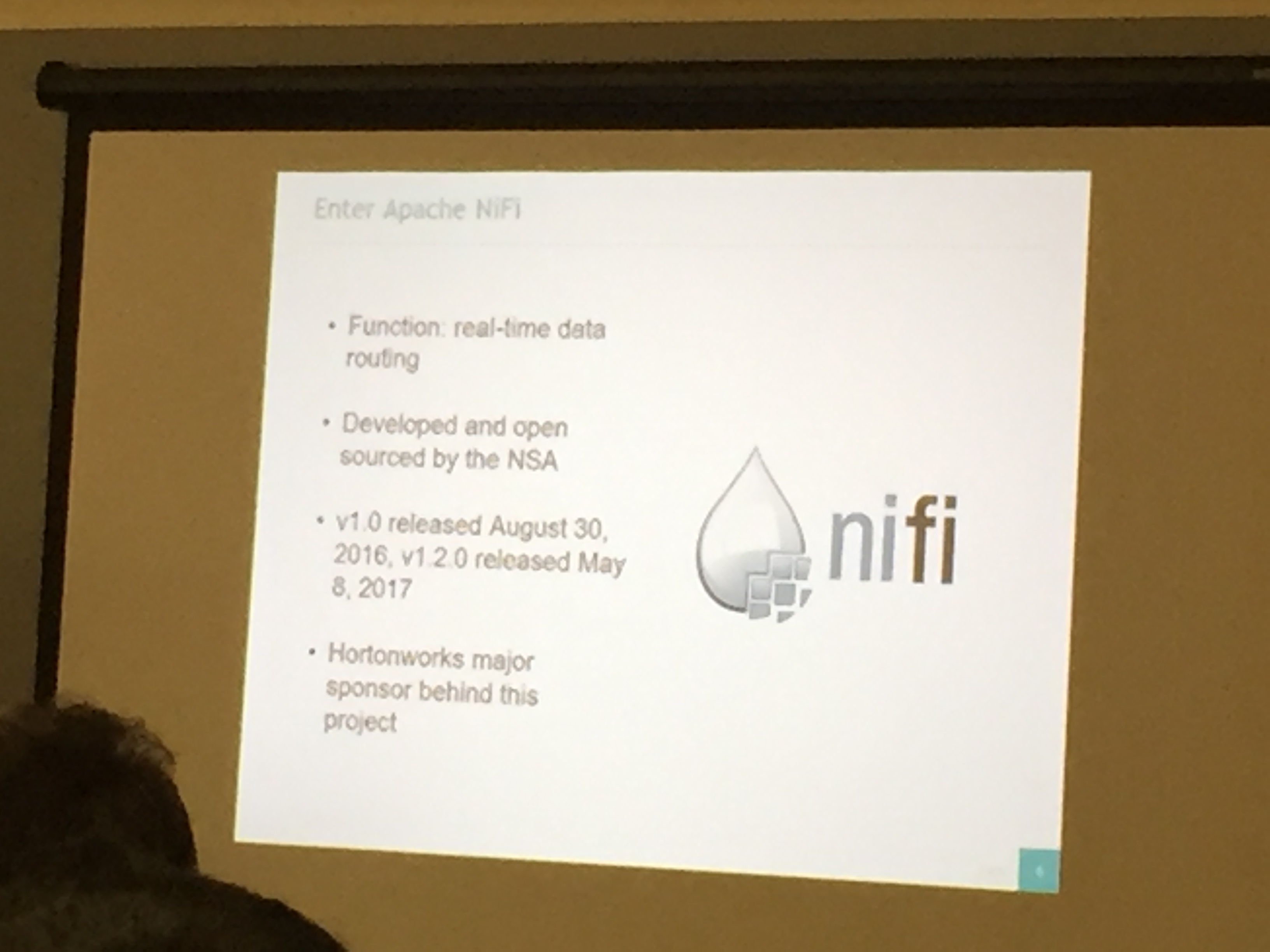

Apache data streaming project – NIFI & MINIFI

Technology

- Apache Nifi – comes with a webserver

- Apache Minifi – very lightweight solution

Usage

- Tail CDC database transaction logs and pipes it to the rest of the Apache NIFI cluster

- listens to port and takes data into stream

- transform data by pulling out attribute into meta key

- can write to specificAWS S3 folder object

- can run Ruby, Python n Java within each Node

Hardware Requirements

- minimum AWS T2.small instance type

- needs to have enough disk space to support the largest possible size of each batch of data

Insight

Data scientist does not want to waste time writing to and from Kafka