2020 Corona virus sell offs

May 2019 US China trade war sell off

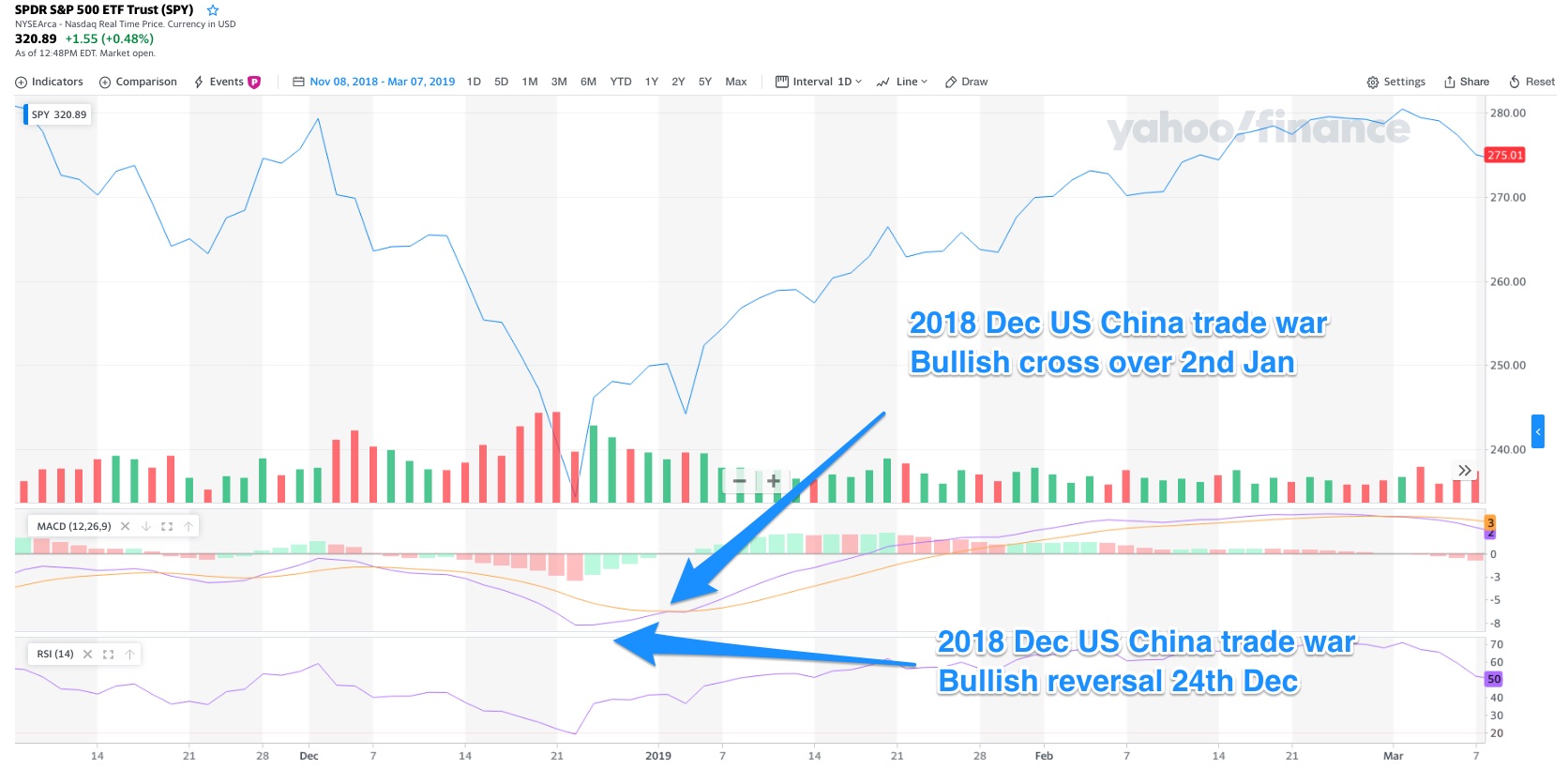

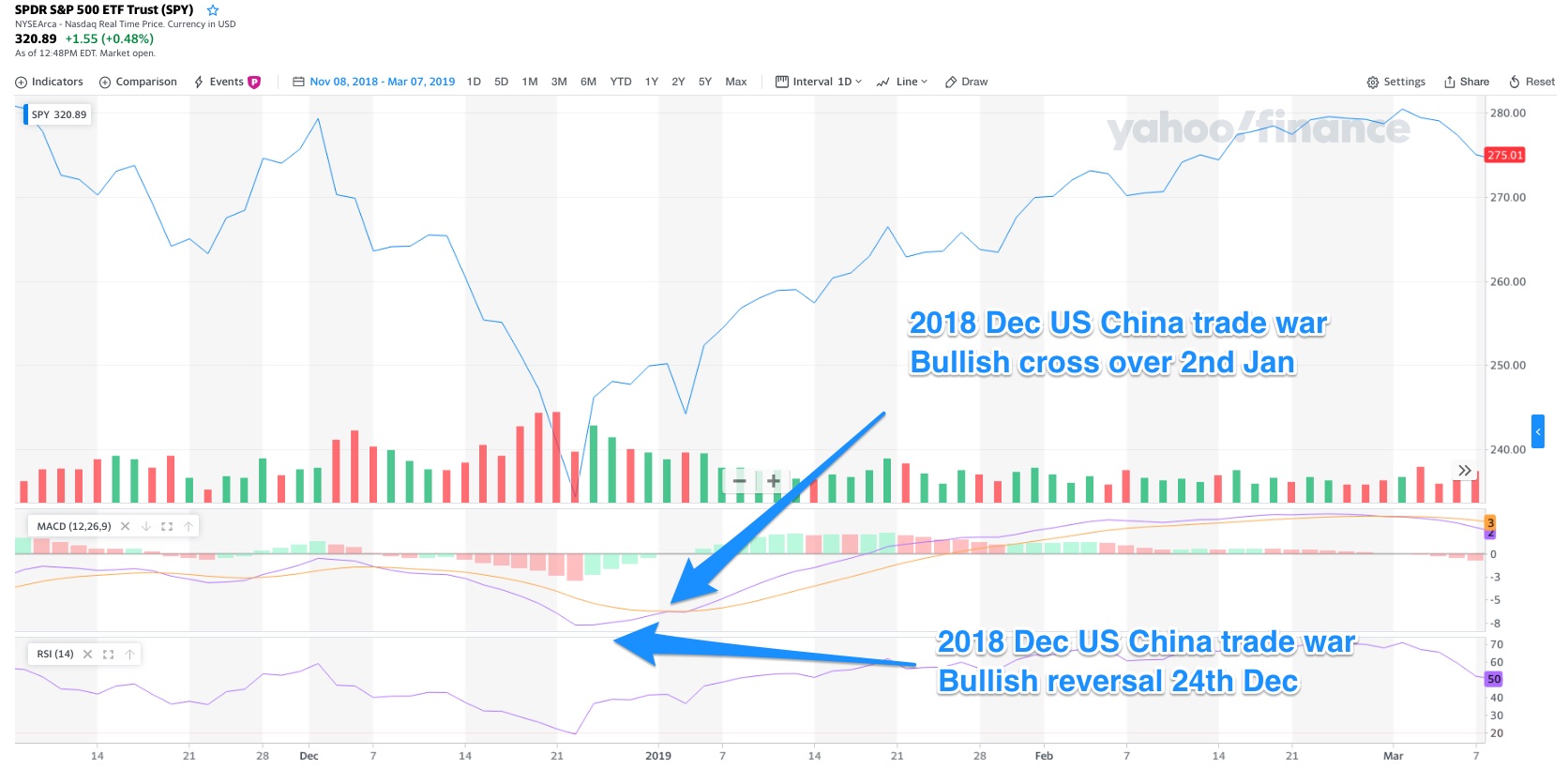

Dec 2018 US China trade war sell off

2003 Sars sell offs

2001 September 11 World trade center collapse

2008 Financial crisis

notes, learnings and reflections for future self reference

2020 Corona virus sell offs

May 2019 US China trade war sell off

Dec 2018 US China trade war sell off

2003 Sars sell offs

2001 September 11 World trade center collapse

2008 Financial crisis

Following the end of world war two, with US being the world’s largest creditor, countries started largely denominating their debts in USD. US in turn pegged USD to a fixed exchange rate with Gold. This agreement was formally known as the Brettonwood Systems.

US experienced difficulty backing this exchange rate during the oil crisis of the 1970s when OPEC started artificially reducing it’s supply of oil thereby driving it’s price in USD. This had a strong downwards pressure on value of the USD which the US propped up through use of their foreign reserves.

Seeing this weakness in US foreign reserve, thereby an discrepancy of the USD against gold, other trading partners started exchanging US dollar for gold. This added further pressure.

To provide relief on their foreign reserves US finally decoupled the fixed exchange rate between USD and gold. This resulted in the collapse of the Brettonwood Systems, leaving USD as the official reserve currency in the world without any underlying backing.

What followed were decades of global growth largely funded by the US government through control of the world’s reserve currency.

Developing countries would sell goods to the US in exchange for USD. Instead of buying US goods in exchange for the USD earned, they would buy US Treasury bills, notes and bonds. This had the effect of maintaining favorable exchange rates for these countries while keeping their products competitive in the US market.

This widespread practice had the long term effect of driving balance of trade deficits in US with it’s trading partners. While negligible in times of strong US domestic GDP growth, this system has of late started exhibiting difficulty sustaining. This is largely due to slow down in US domestic growth and its inability to scale to support trading partners that 4 times times the population size of the US.

It is advised countries which had long relied on this approach to domestic growth transit their economies to become net importers as soon as their economy gains the necessary growth momentum to do so.

Core inflation at 1.8% continues to run below target 2%.

Federal reserve decides upon another 0.25% cut in interest rates, targeting range of 1.5% to 1.75%.

Action is taken to provide meaningful support to the economy in response to global economic slowdown and the increasing disinflationary pressure felt from around the world. The special characteristics of this particular slow down is a lack of any large imbalances in the economy.

2% symmetrical inflation target

Zuckerberg Warns China’s Censored Internet Could Still Win Out

https://www.bloomberg.com/news/articles/2019-10-17/zuckerberg-warns-china-s-censored-internet-could-still-win-out

Apple bows to China by removing Taiwanese emoji

https://qz.com/1723334/apple-removes-taiwan-flag-emoji-in-hong-kong-macau-in-ios-13-1-1/

Christian Dior apologizes for omitting Taiwan from Chinese map

https://www.breitbart.com/national-security/2019/10/17/china-bullies-christian-dior-apologizing-omitting-taiwan-map/

China exerts pressure on NBA to fire key executive for tweet on Hong Kong unrest

https://www.nytimes.com/2019/10/17/sports/basketball/nba-china-adam-silver.amp.html

Solomon island switches relationship to China from Taiwan

https://www.nytimes.com/2019/09/16/world/asia/solomon-islands-taiwan-china.amp.html

Kiribati switches relationship to China from Taiwan

https://amp.theguardian.com/world/2019/sep/20/taiwan-loses-second-ally-in-a-week-as-kiribati-switches-to-china

Southeast Asia balances between Chinese Markets and US defense

https://www.nytimes.com/interactive/2018/03/09/world/asia/china-us-asia-rivalry.html

Facebook Warns Washington That Beijing Wins If Libra Plan Fails

https://www.bloomberg.com/news/articles/2019-10-17/facebook-warns-washington-that-beijing-wins-if-libra-plan-fails

China simultaneously experiences imported deflation and inflation.

Drop in global demand for exports causes credit to unwind within the manufacturing sector.

Swine flu and depleting foreign reserves causes price pig to increase.

This will be a useful case study to observe the monetary and fiscal policy China implements to deal with simultaneous inflationary and deflationary pressures.

China Factory Deflation Worsens as Pork Drives Consumer Prices https://www.bloomberg.com/news/articles/2019-10-15/china-factory-deflation-worsens-as-pork-drives-consumer-prices

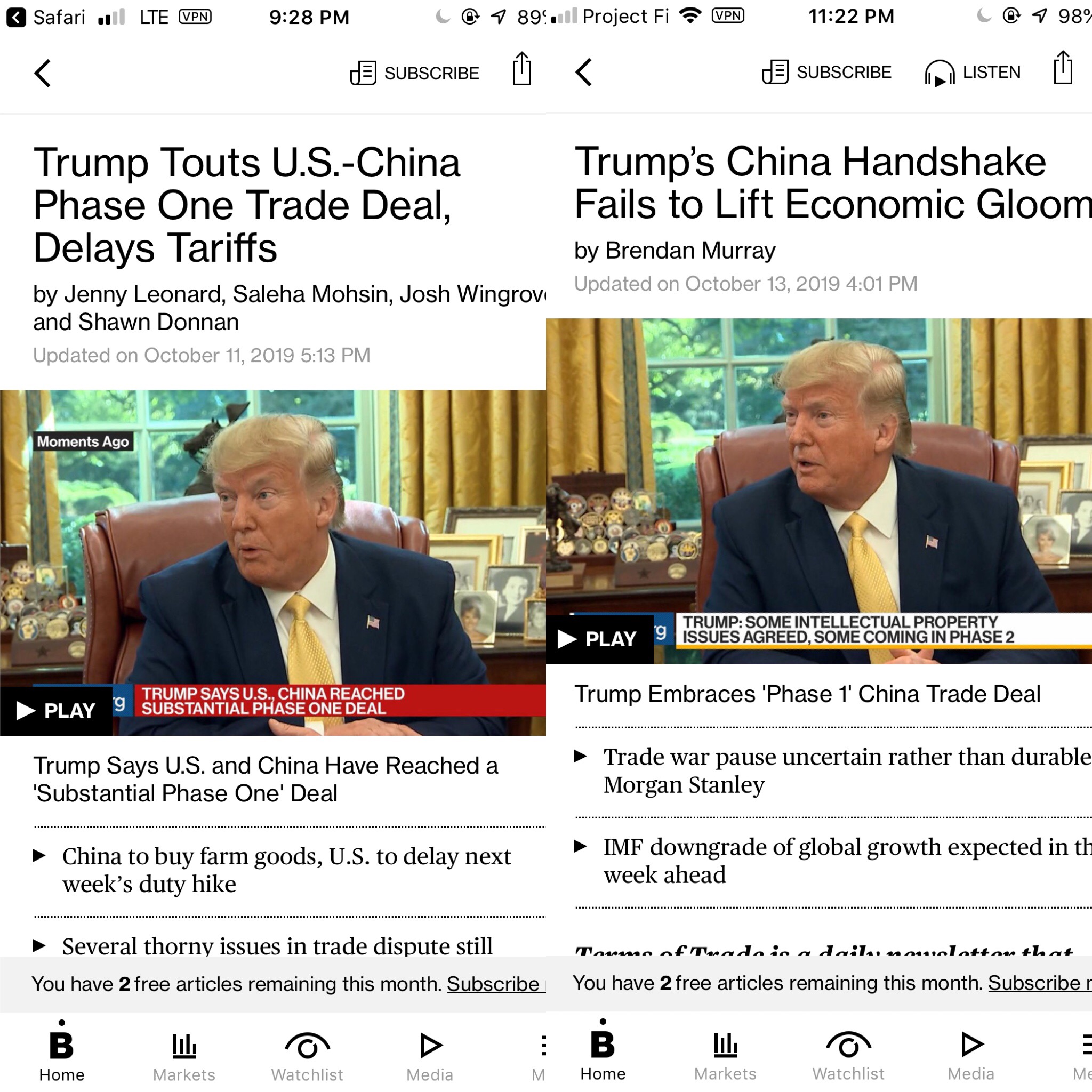

Fascinating AB testing observed on the entire world’s population by major news networks.

Barely 72 hours after the announcement of phase 1 trade deal, its accompanying mass euphoria and surge in world markets, the almost same exact photo with some slight changes in copyrighting and background color is released into production.

It will be fascinating to observe the world’s reaction to this new AB year variant that just got released and the corresponding market price levels.