The optimized route for a startup is to first deploy a small skeleton crew to focus on mining for the insights on human behavior with cheap experiments that will support a viable business model before raising money and scaling up the operations.

Big organizations tend to forget the insights that lead to the founding of the company. That is how large companies get disrupted by new entrants who “rediscover” them.

If there is a company out there that is solving a problem you are trying to find a solution for but you cannot think of it off the top of your head, they might as well have been dead.

What you think might work will usually not. It is only when you land up in a promising domain and start mining for insights in that domain do you start finding ones that are useful for building a company with.

Screenwriting is probably the only occupation where you can envision how all the moving pieces fits together while you are lying in bed. Writing a business plan is a very useless undertaking because unless you have tested your business model to get actual market response, you will not know if it would work or not work. This is much of other inductive processes where much of the building blocks required to work are out there in the environment yet know and to be discovered.

Do not be fixated on what should but be instead embrace on what is and work for there when it comes to human nature.

Humans are motivated beyond pain and pleasure.

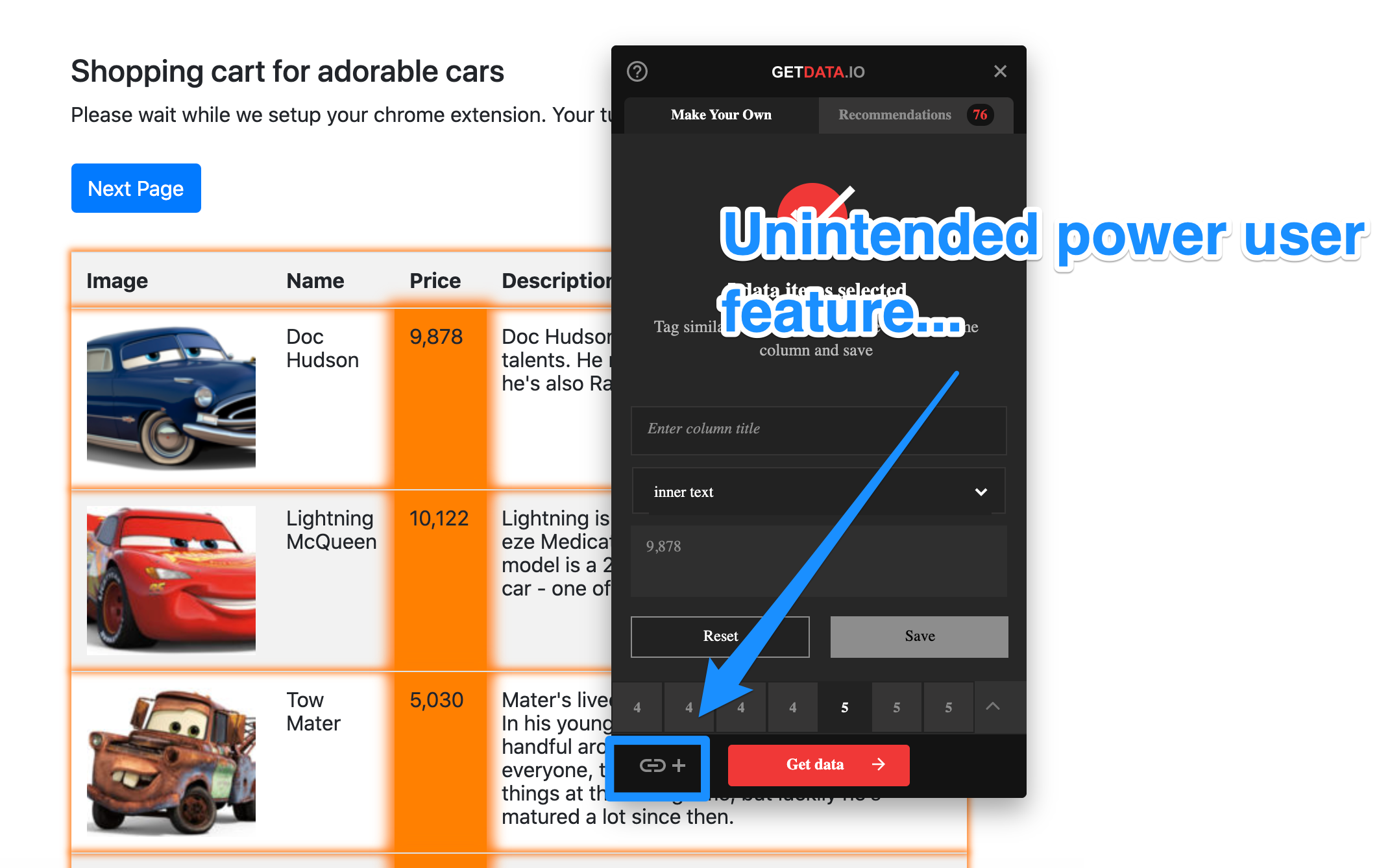

No one has considered hyperlinks themselves as important data elements.

It is usually the simplest actions backed by the most fundamental insights that drives the largest consumer adoption.

People feel that sense of accomplishment when they gather stuff thanks to our hunter gathering roots. They might not even need it at the end of the day.

Social book marking just died when most of their operators pivoted away from the central idea in 2005

- Stumble upon

- Digg

- Reddit

- Pintrest

- Trello

The mass adoption of Slack and Quip might be a great channel for growing such an idea again but for the enterprise space.

The success of YouTube can be speculated to be due to:

- In baked flash media code into browsers

- Increase in bandwidth

- Delaying the payment of royalty fees and taking down of copyrighted contents

- They got sold for 1.2billion but paid of 750million in terms of royalties

Mark Cuban is a fake billionaire for selling Real networks to AOL which eventually got shut down after six months. Reason for Real Network being empty is because while it looking really impressive on the outside, it did not capture any of the user behaviors.

People only build shared reality with others they consider part of their own tribe. They might interact with others who are not considered part of their own tribe but will not go about building a shared reality with them. This is how echo chambers happen.

Related readings

- Tory Higgins, “Beyond Pleasure and Pain: How Motivation Works”

- Tory Higgins, “Shared Reality”