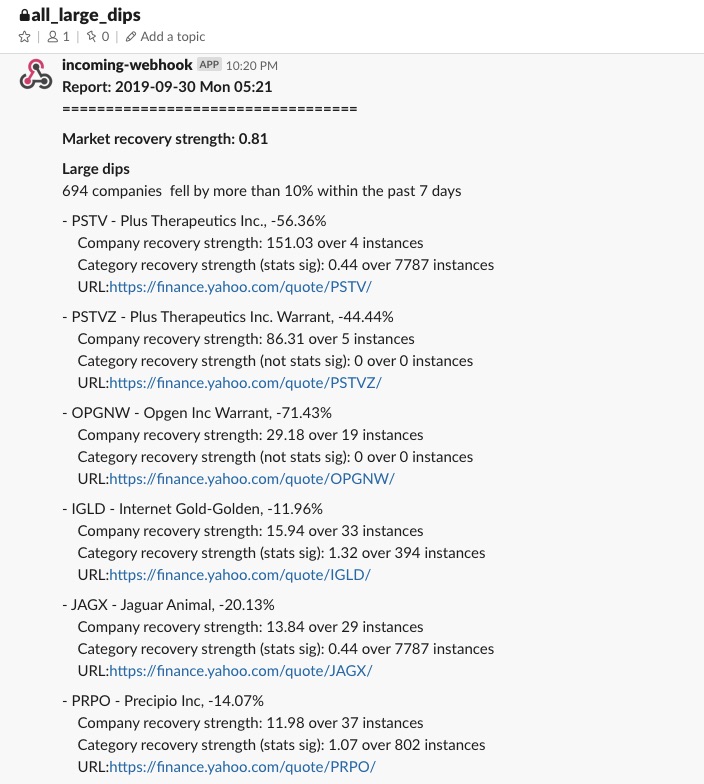

One of worst mistakes I made was during the 2015/6 Oil crash. I bought into shares of oil exploration companies instead of buying the oil directly.

It was a very painful and expensive mistake. While the price of oil made a nice recovery since then, the exploration companies never made it through to the other side. Majority of them filed for bankruptcy during the height of the crisis. Unfortunately they took on too much debt when the times were good and were unable to finance the debts and ongoing operations through the continued sales of their inventory when situations turned south.

The lesson learned is that when buying the dip, it’s important to make sure that not just yourself but the underlying assets you hold are resilient to the environment shock. Utilization of excessive leverage reduces the resilience. Over expansion into fancy offices and overstaffing is another form of excessive leverage. Tech startup founders are often caught red handed committing these mistakes.

With regards to oil, until the world stops relying on plastic, chemical lubricants and switches completely to alternative forms of energy, we should not expect the price of oil to fall to zero anytime soon.

A simple acid test to figure out the intrinsic value of oil is to ask your neighbor for his tank of gasoline for free. The most likely response you will get from him is a suggestion to go f**k yourself…?!?