2018 Oct / Dec SPY decline

During the period of Dec 2019, the SPY index ranged between

- 3rd Oct 2019 – USD 291.72

- 24th Dec 2019 – USD 234.34

The steep decline in share price can be attributed to the ongoing trade war wage by the Trump administration and the expected Federal Reserve rate hike. The decline attributions are as follows:

- Trump administration

- USD 291.72 – USD265.37

- 3rd Oct 2019 – 13th Dec 2019

- decline of 9.03% off of USD291.72

- Federal reserve rate hike

- USD265.37 – USD234.34

- 13th Dec 2019 – 24th Dec 2019

- decline of 10.63% off of USD291.72

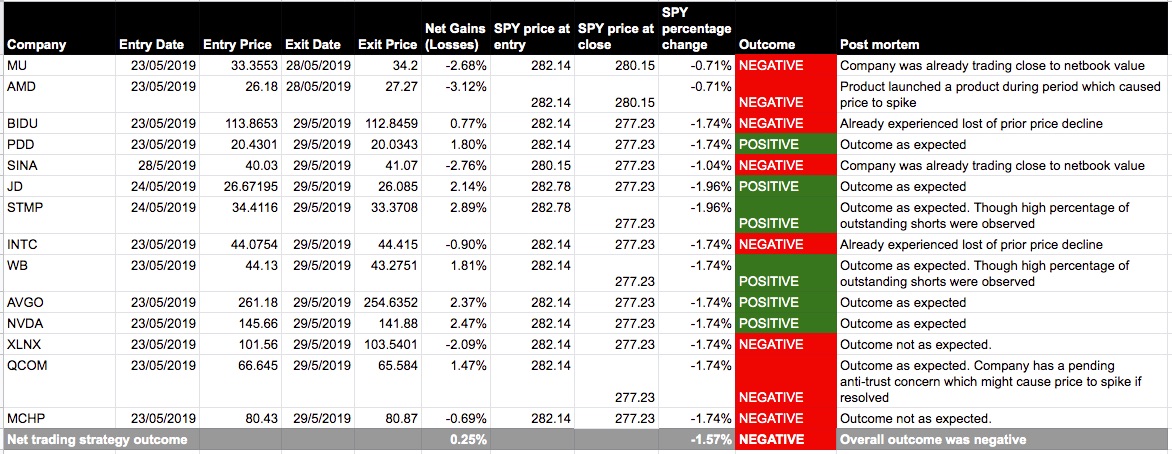

2019 May / June SPY decline

During the period of May and June 2019, the SPY index ranged between

- 3rd May 2019 – USD 294.03

- 3rd June 2019 – USD 274.57

The steep decline in share price can be attributed to the two front trade war wage by the Trump administration which caused a 6.61% price decline

Of the recovery that occurred after 3rd June 2019, the following parties could be attributed

- Federal reserve

- USD274.57 – USD 287.65

- June 3 2019 – June 7 2019

- 4.76% recovery off of USD274.57

- Trump administration

- USD 287.65 – USD 292.32

- June 10th 2019 – June 18th 2019

- 1.70% recovery off of USD274.57

Conclusion

While both the Government administration and the Federal reserve have observed impact on the SnP index, it is observed the Federal reserve has a slightly higher level of impact.

- Oct/Dec 2019: 10.63% versus 9.0%

- May/June 2019: 4.76% versus 1.70%