Trust is the ultimate source of wealth in any society. The level of manifested physical wealth correlates positively with the level of perceived trust members of society have for an entity.

When an entity, be it a phenomena or a behavior, is observed to be consistent across time without much falter, it soon becomes accepted as the norm. Overtime this norm gets deeply embedded within a society and becomes an integral part of its culture. It thus becomes trusted and a source of credibility.

Societal commerce is built on trust. Trust accumulated through consistency overtime can be converted to other forms of tangible currency. These currencies can then be used to direct resources within the society towards the achievement of very material goals.

When comparing between two entities that are embedded within the cultural fabric of society, the one that exhibits a higher level of consistency inevitably gains more trust. This explains why while fiat currencies comes and goes, the value of gold remains consistent across time.

While it might be tempting to equate trust with value, there is a subtle difference. While trust elicits value, value need not necessarily elicit trust.

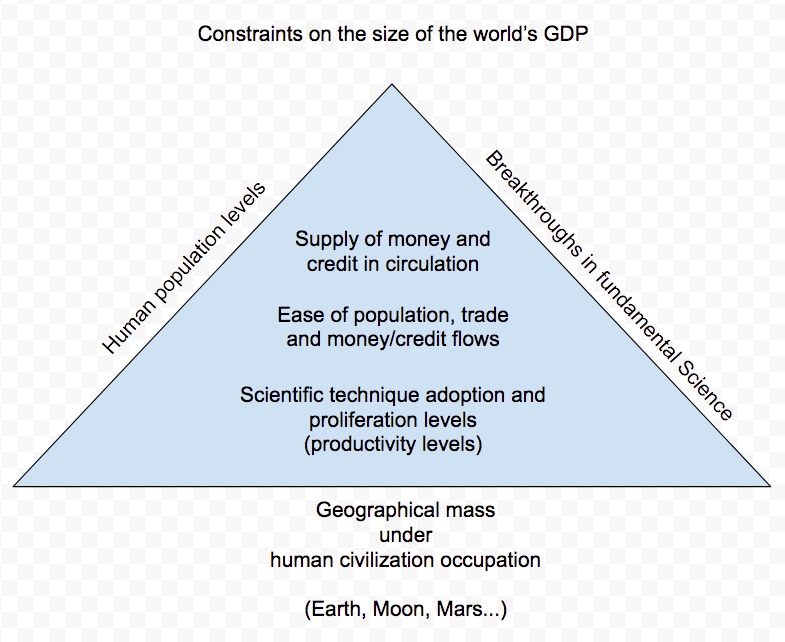

Expressing the entire civilization’s undertaking at any point in time as an linear equation, any essential variable that happens to be the most restrictive in supply at that point inevitably becomes the most valued. However wide fluctuations in value does not elicit trust in the long run.

Sources of trust

- the rotation of seasons and our subsequent practice of agriculture

- the constant speed of light and it’s use in Einstein’s theory of relativity

- gold with its scarcity and it’s persist use as a store of wealth

- well run institutions with well defined constitutions

- fiat currencies with under sound government regimes

- individuals who exhibit consistent behavior overtime

Qualities of viable currencies

- Ability to be divisible

- Ability to be moved

- Ability as a store of wealth overtime

- consistent levels of supply

- scarcity

Functions of currencies

- a means to facilitate transactions

- a store of wealth

Examples of trust erosion

Example 1: Michigan Pulls $600 Million From Ken Fisher an individual After Lewd Remarks

https://www.bloomberg.com/news/articles/2019-10-12/michigan-pulls-600-million-from-ken-fisher-after-lewd-remarks

Example 2: 1918 Germany as an institution, towards the tail end of WWI.

When it became evident that the country will loss the war, it experienced increased inability to raise debt to in domestic currency denomination to continue financing its war efforts. It’s currency soon lost it’s reserve currency status and it was increasingly forced to denominate debt in foreign reserve currencies.

Post WWI debts denominated in domestic currency where inflated away through printing of cash by the German government to pay of debts denominated in foreign currencies.

Example 3: Africa use of glass beads as a failed form of currency

Europe was able to cheaply produce this in abundance . Europeans for a period were able to exploit this asymmetry by exchanging cheap glass beads for valuable natural resources. When value within the African society became depleted, Europeans were eventually able to subjugate the entire African population and exploit them through the slave trade.

Example 4: Wall Street crash and the Great Depression of the 1930s.

Bankers increasingly became concern of easy credit driving share prices to stratospheric valuations. An eventual tightening of credit lead to rapid deleveraging within the system. The lack of trust within the system prevented the circulation of money and credit. The central bank ultimately had to step in to restore trust.

It did so by first preventing the flight to value. This was achieved through the banning of conversion of USD dollar to gold.

Example 5: An ongoing slow erosion of fiat money

With the deliberate pursuit of constant 2% yearly inflation by central banks around the world current fiat money are failed stores of wealth .

The currency of the Roman Empire is a perfect example of where we will be headed. Overtime less gold per coin is used. Their currency was ultimately replaced by paper which allowed rampant printing by the government during times of war. The effects of inflation eroded the Roman empires currency as a long term store of wealth.

Examples of persistent sources of trust

- The institution of the Catholic Church

- The consistent adherence to a set of sound principles by Berkshire Hathaway’s reinsurance business over multiple decades.

- Federal reserves consistent adherence to the dual mandate of 2% inflation and low unemployment rates

Conclusion

To build trust is to build wealth. The key to doing so is to adhere and operate on a consistent set of sound principles over across time and in all environments. Being slow and steady is a pre-requisite of this process.

Related readings

- Principles, Ray Dalio

- Understanding Big Debt Crisis, Ray Dalio

- Manias, panics and crashes, Charles Kindleberger and Robert Aliber

- The Asian financial crisis, Shalendra Sharma

- The end of wall street, Roger Lowenstein

- When genius failed, Roger Lowenstein

- The bank credit analysis handbook, Jonathan Golin and Philippe Delhaise

- The Fate Of Rome, Kyle Harper

- The savings and loans crisis by James Barth Susanne, Trimbath and Glenn Yaho

- The Snowball, Alice Schroeder

- The bitcoin standard, Saifedean Ammous