Trading Heuristics

Chain of events and decision making

The decision making processes from June 2019 after the federal reserve signal likelihood of cutting interest rate leading up to the 2019 August downward mean reversion of the SnP.

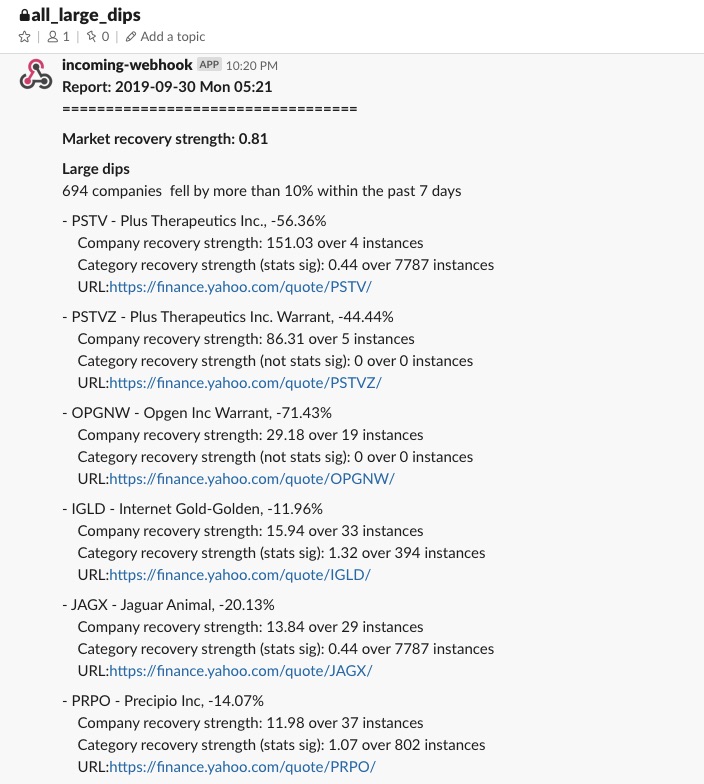

19th June 2019, Federal Reserve signals for first time likely decrease of interest rates

Federal Chairman expresses concerns about potential cross winds caused by US trade policies and its impact on their dual mandate.

10th July 2019, news paper reports SnP reaches all time high

SnP on the cusp of crossing 3000 threshold for the first time to an all time high. Market is euphoric. Trade issue between US/China yet resolved but discussions are underway.

Short positions SQQQ and SRTY were utilized as hedges against downward macro environment reversion risk when the SnP extended beyond 3000 to reach an all time high

1st August 2019, US announcement of 10% tariffs on US300 billion imports from China starting September 2019

on 1st August, 24 hours after actual interest rates cut, Trump signaled 10% tariffs on USD300 billion Chinese import. SnP dropped.

Exited SQQQ and SRTY for 10% capital gain after reaching 30SMA and 50SMA range. Net combined loss to portfolio was 0.5%. Left remaining long positions open.

4th August 2019, Chinese response

On 4th Aug 2019, China’s exchange rate dropped for the first time below 7RMB/1USD.

5th Aug 2019 trading day

On 5th Aug 2019, China announced they will halt all imports of agricultural goods from US.

Portfolio continued declining an additional 2% on the trading day of 5th August 2019.

Closed all long positions with the exception of REITs

Decline overview

- SnP

- REITs

- Value shares

- Growth shares

6th Aug 2019 trading day

On the evening of 6th Aug 2019, China announced decision to control fluctuation of RMB exchange rates to USD

Bought into TQQQ and URTY at below 30SMA and 50SMA

7th Aug 2019 trading day

TQQQ and URTY automatically exited at the mid point between the two following highs and lows:

- highest point before Trump’s tariff announcement came into effect

- lowest point after China’s halt on US agricultural imports and RMB/USD breaking 7 came into effect

Related readings