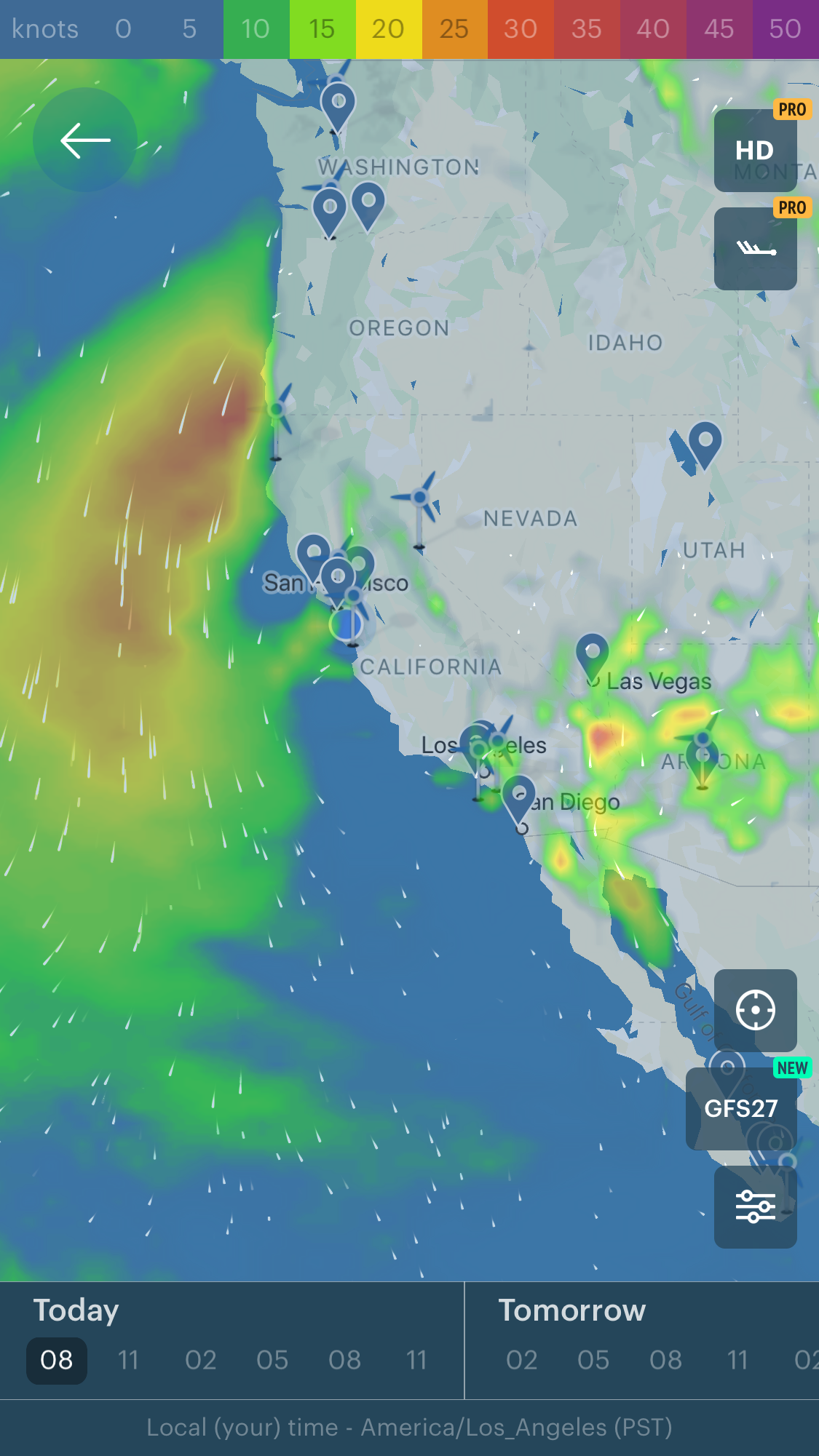

NYMT has been observed to shift much of its portfolio to CMBS from agency RBMS over the year.

This is to guard against the likelihood of prepayment risk and reinvestment risk associated with the lowering interest rate environment we are seeing right now as the US/China trade war forces lower interest rates and a flatter yield curve. The downside to this strategy is that most of the loans will be maturing within 10 years as opposed to 30 years.

Performance across various interest rate environments

In a stable interest rate environment a rotation to RMBS can help guard against reinvestment risk and prepayment risk since loans mature over a period of 30 years and borrowers are unlikely to increase their rates of prepayment.

And since these are agency RMBS, the government become the ultimate underwriter in the event of defaults.

In an environment where interest rate increase and spread widens, increase in short term interest rates pinches into profit margins thus lowers net interest income for all both types of MBS. Also likelihood of default increases.

Overview of CMBS versus RMBS

CMBS typically matures over a 10 year period. It pays interest during the entire period with a final lump sum principal payment at the end.

Borrowers will usually extend another loan to pay off lump sum as the current loan matures. The new loans is usually at then prevailing interest rates.

CMBS are usually backed by 10 to 300 commercial properties.

RMBS matures over a period of 30 years. It pays both interest and principal steadily over the entire course with increasing amounts of interest paid to the end.

RMBS is usually backed by thousands of homes.

Types of risks:

- default risk – property does not generate rent to cover interest

- maturity risk – borrower can not repay final lump sum at maturity

- prepayment risk – more is paid down rapidly so less overall interest income generated from loan

- reinvestment risk – associated with prepayment risk. If mortgage is paid down fairly quickly due to low interest rate environments, owner of lender will be forced to lend out loans in prevailing lower interest rate environments

- extension risk – less principal is paid down by borrower per period because interest rate has increased

Of the above CMBS is usually only subjected to default risk and maturity risk.

Arrangements are within contract to guard against prepayment risk and extension risk in CMBS.

Default risks for CMBS are low unless tenants are no longer able to pay for rental of commercial space. Senior CMBS were not much affected even during 2008 / 2009

Other issues for consideration

Subordination are important points for consideration. Senior loans with 30% subordination means it will only start experiencing default when 30% of tranche beneath it has defaulted.

CMBS annual default rate peaked at 4.07% in 2010 while cumulative default rate peaked at 13.52% in 2013.

Related references

https://www.lordabbett.com/en/perspectives/fixedincomeinsights/investment-brief-commercial-mortgage-backed-securities.html

https://www.sec.gov/ix?doc=/Archives/edgar/data/1273685/000127368519000074/nymt-06302019x10q.htm#s4E8231C084AE58E780F8E58D6BD4C381